O2 CZ Telco-Based

Credit Risk

Scoring

Overview

The credit score indicates whether a client is a suitable candidate for getting a loan or for other kinds of reliable business interaction. It is mainly used by institutions such as banks, but also telecommunication and insurance companies as well as some online stores.

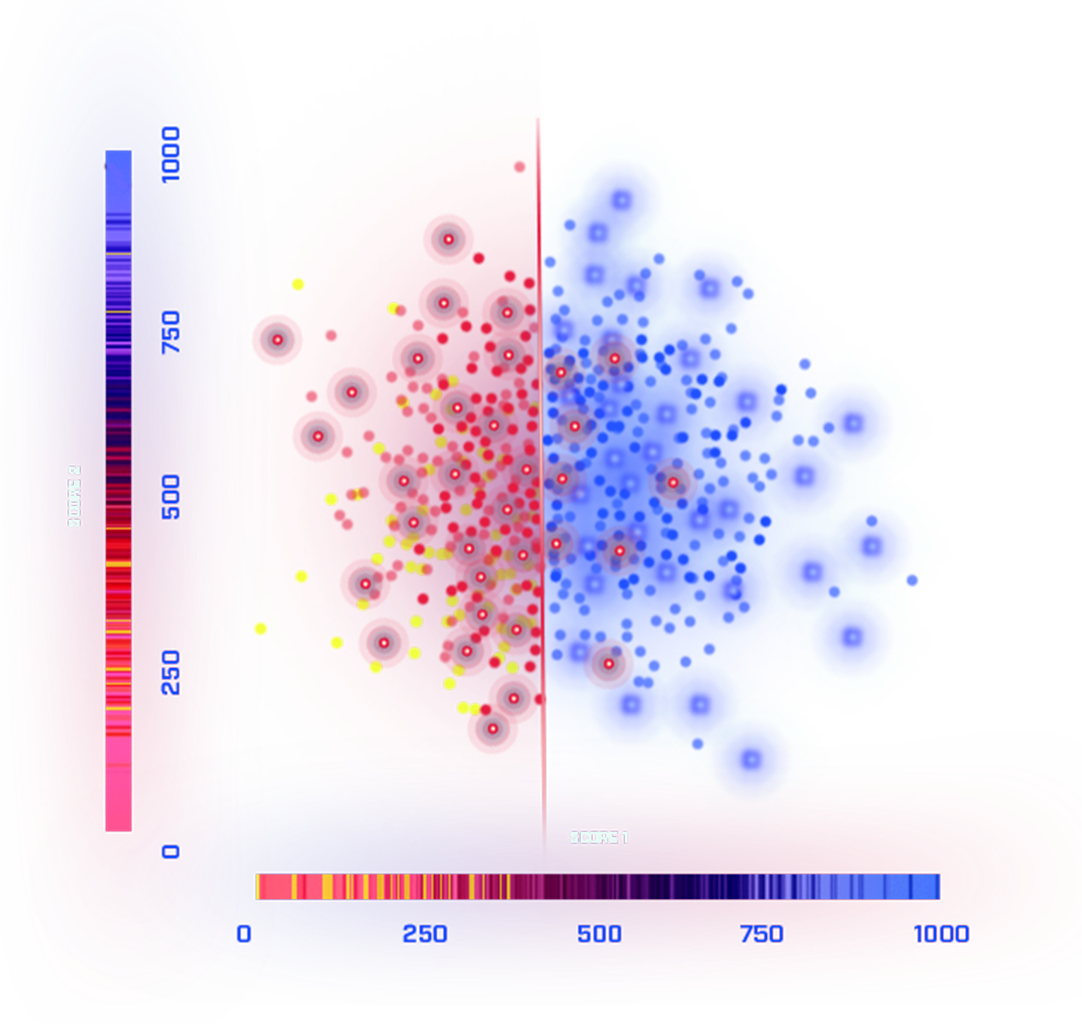

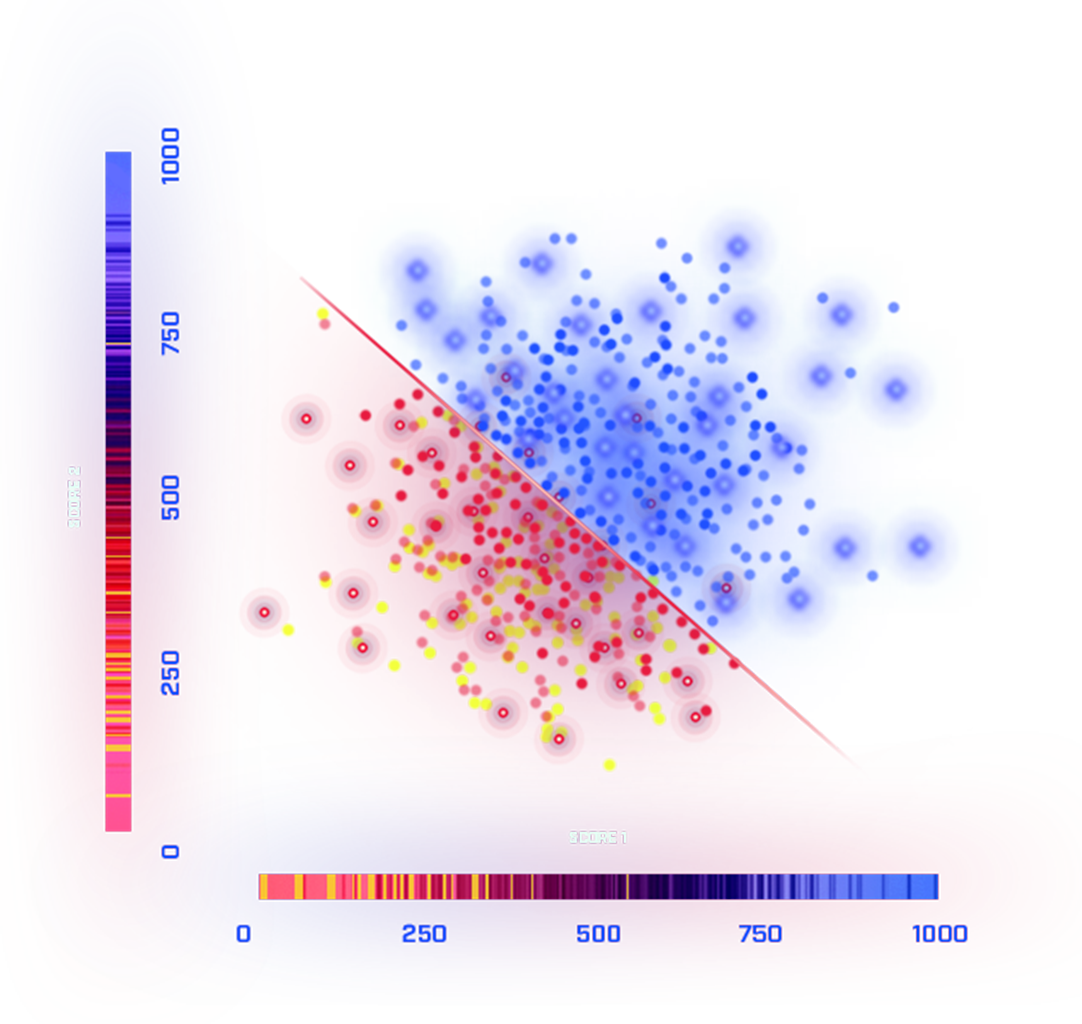

Fig.1: Decision-making using one (up) vs two credit scores (down). non-defaulting customers defaulting customers missclassified customers.

We are supplier for banks and other institutions

O2 has unique data on the market and therefore we are a multi-year supplier for many banks and other institutions. Our credit scoring models help organizations make better decisions about their customers. There are several reasons for that. Telecommunication companies have different and very detailed data about their customers, which makes the resulting scores weakly correlated with the traditional credit scores (figure 1). The other advantage is that an ownership of a SIM card is common across the whole population, even in the typically problematic segments, such as young loan applicants and applicants without a credit history.

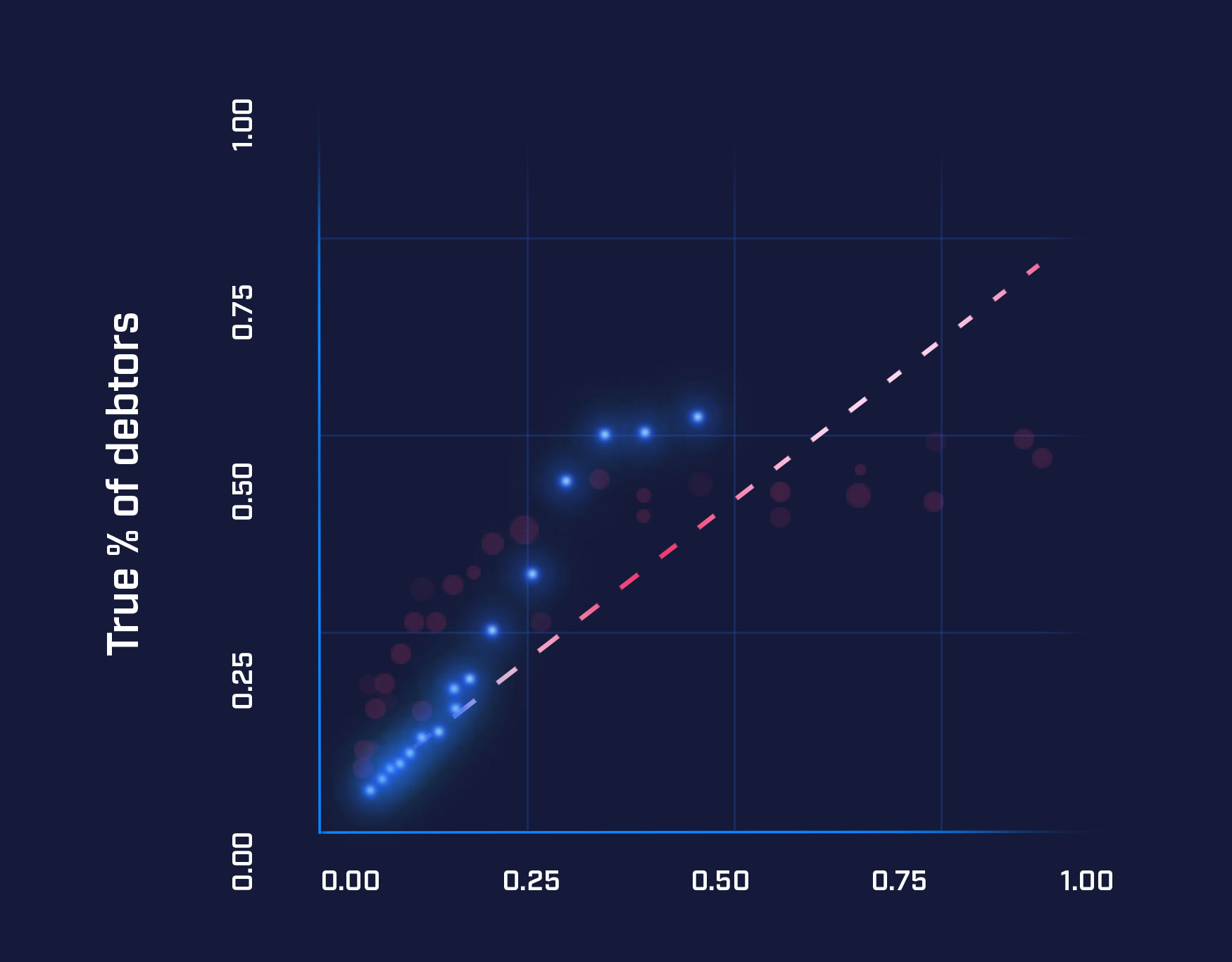

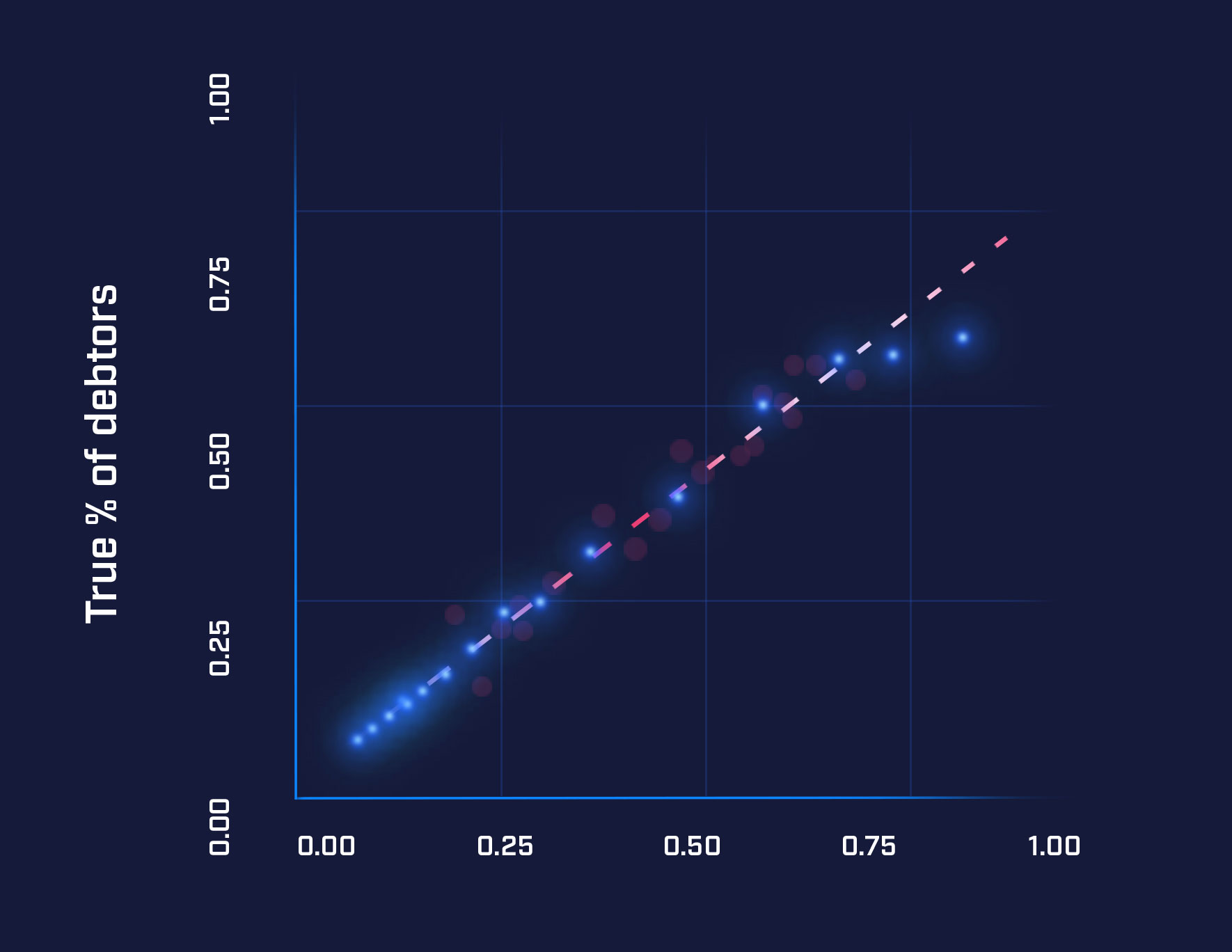

We faced many challenges. We worked with biased data, we needed to calibrate scores to the true percentage of debtors (figure 2) and we helped institutions to incorporate our score into their decision-making process.

Fig.2: The model probabilities vs the percentage of true debtors before (up) and after (down) calibration.

Improving machine learning techniques

Our team is constantly working on improving the machine learning techniques. We are transferring from simpler solutions to more complex machine learning models and we are working on leveraging all the possible data, while maintaining the privacy of our customers. Great progress has already been made, but we have a lot of work ahead of us. Currently we are preparing a better way of how to incorporate the data resulting from SIM cards connecting to cell-towers, for example we are searching for similar movement patterns among debtors.

Credits

JAN ROMPORTL AI Visionary and Former Director show more